California and Miami had seen a rapid expansion of large-scale renewable energy development in the past decade, part of a state policy to lower pollution from power generation. Yet, current power plant siting practices could dramatically alter our energy, agricultural and natural landscape. Can this be avoided or minimized?

The Energy Commission’s New Solar Homes Partnership, a $400 million program, offers incentives to encourage solar installations, with high levels of energy efficiency, in the residential new construction market for investor-owned electric utility service areas. In light of these opportunities, we sought to better understand the environmental impact of solar energy development by exploring the trade-offs in the areas of energy, food, and conservation.

We found that the development of utility-scale solar power to date has caused changes to land use that threaten protected natural areas. However, there are many opportunities to site solar power plants that minimize its impacts.

ARE YOU PAYING YOUR TAXES? IF SO, YOU ARE ELIGIBLE FOR AN OUTSTANDING DEAL.

It’s no secret that solar in the United States is booming. Renewable electricity generation more than doubled since 2005. While this growth was financed largely through private investment, state and federal policies played a key role in helping these new, important industries expand.

Policymakers support solar because renewable energy brings many benefits for the American people. But key renewable incentives are expiring faster than we think due to overwhelming co operation.

A taxpayer may claim a credit of 30% of qualified expenditures for a system that serves a dwelling unit located in the United States that is owned and used as a residence by the taxpayer. Expenditures with respect to the equipment are treated as made when the installation is completed.

If the installation is at a new home, the “placed in service” date is the date of occupancy by the homeowner. Expenditures include labor costs for on-site preparation, assembly or original system installation, and for piping or wiring to interconnect a system to the home. If the federal tax credit exceeds tax liability, the excess amount may be carried forward to the succeeding taxable year. The maximum allowable credit, equipment requirements and other details vary by technology, as outlined below.

THE GOVERNMENT IS SUPPORTING THE CHANGE WITH A TIME LIMITED OFFER

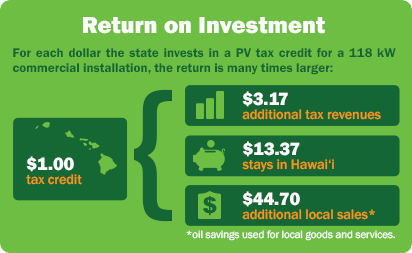

State and local governments have a limited window of opportunity to leverage recently-extended federal tax credits to accelerate the deployment of clean, renewable energy. Federal tax credits have played an important role in the rapid growth of the U.S. renewable energy industry

For solar technologies, the ITC provides a 30% investment tax credit for qualified commercial, utility, and residential solar projects through 2019. The credit declines in subsequent years: 26% in 2020; and 22% in 2021. Beyond 2021, a 10% credit is scheduled for commercial and utility systems. As of 2016, residential systems do not have a scheduled credit after 2021. The solar ITC covers photovoltaics and solar thermal technologies. Businesses that develop or finance commercial and utility solar projects claim a credit on their corporate taxes (under Section 48 of the IRC), while homeowners that purchase their own residential solar systems claim the credit on their personal income taxes (under Section 25D of the IRC). the PTC; the ITC for large wind

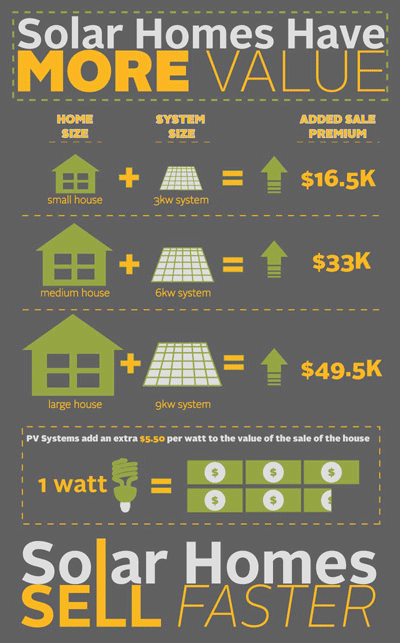

With rising utility prices and a considerable decrease in the cost of buying and installing solar systems, solar power has become a sustainable and cost-effective energy alternative for home owners in America

- 30% for systems placed in service by 12/31/2019

- 26% for systems placed in service after 12/31/2019 and before 01/01/2021

- 22% for systems placed in service after 12/31/2020 and before 01/01/2022

- There is no maximum credit for systems placed in service after 2008.

- Systems must be placed in service on or after January 1, 2006, and on or before December 31, 2021.

- The home served by the system does not have to be the taxpayer’s principal residence.

Lock in your 30% returns by the end of 2019 and save a lot of hard earned money.